CryptoweeksBloomberg: Your Guide to Navigating the World of Cryptocurrencies & More

The world of cryptocurrencies has become a focal point of financial discussion in recent years, with its rapid growth and volatile market trends capturing the attention of investors, regulators, and technology enthusiasts alike. One of the most prominent sources of cryptocurrency coverage today is CryptoweeksBloomberg, a dedicated feature from Bloomberg that brings in-depth analysis, expert insights, and comprehensive market updates on the world of digital assets. By providing reliable, timely, and clear information, CryptoweeksBloomberg has become a trusted resource for both seasoned investors and newcomers keen to understand the dynamic world of cryptocurrencies.

The Role of Bloomberg in Cryptocurrency Reporting

Bloomberg is renowned for its authoritative and accurate coverage of global financial markets. As digital assets such as Bitcoin, Ethereum, and various altcoins continue to garner interest, Bloomberg’s commitment to providing clear and balanced reporting on cryptocurrencies has become more crucial than ever. Through its CryptoweeksBloomberg section, Bloomberg helps bridge the knowledge gap by offering timely, accessible content on emerging cryptocurrency trends, blockchain innovations, and regulatory updates. In a rapidly evolving sector known for its complexity, CryptoweeksBloomberg ensures that the latest developments are presented in a way that both experts and general audiences can understand.

The launch of CryptoweeksBloomberg underscores Bloomberg’s foresight in recognizing the significance of blockchain technology and digital currencies. With cryptocurrencies now a legitimate asset class, it is essential for media outlets to provide detailed reports and analyses that help shape investor decisions and public perception. Bloomberg’s dedication to educating and informing its audience plays a pivotal role in the broader acceptance of digital assets as a part of the global financial ecosystem.

Why Cryptoweeks Matter

The CryptoweeksBloomberg feature offers much more than basic news updates. Its in-depth coverage and multifaceted approach make it an invaluable resource for anyone involved in or interested in the world of cryptocurrency. Here’s why CryptoweeksBloomberg matters to both investors and enthusiasts:

Market Insights

One of the standout features of CryptoweeksBloomberg is its ability to provide detailed market insights. Bloomberg breaks down complex data about the cryptocurrency market’s performance, covering price movements, market capitalization, and trading volumes of major digital currencies like Bitcoin, Ethereum, and altcoins. This enables readers to understand the current state of the market and stay informed about key trends.

For investors navigating the notoriously volatile crypto market, having access to timely, actionable insights is essential. CryptoweeksBloomberg’s reports often feature expert analysis on what’s driving market trends and how to make informed decisions based on current data. In times of significant market fluctuations, this type of reporting can be crucial for spotting potential buying opportunities or mitigating risks associated with market downturns.

Regulatory Updates

Cryptocurrency markets are heavily influenced by regulatory decisions, and CryptoweeksBloomberg excels in keeping its audience informed about the latest regulatory developments. With governments and regulatory bodies worldwide taking varying stances on cryptocurrencies, understanding how these decisions affect market behavior is crucial for anyone involved in digital assets.

Bloomberg’s coverage includes key actions taken by regulatory bodies such as the U.S. Securities and Exchange Commission (SEC), new tax laws related to crypto transactions, and developments in global crypto regulations. For instance, CryptoweeksBloomberg has provided analysis on landmark decisions such as the adoption of Bitcoin as legal tender in El Salvador and the regulatory landscape in countries like China, which have imposed heavy restrictions on crypto trading.

The impact of regulation on the crypto market can be twofold—while clear rules can provide legitimacy and invite institutional investment, overly strict or unclear regulations may dampen innovation and cause market instability. CryptoweeksBloomberg offers a balanced view of how regulations are shaping the crypto landscape, allowing investors to better navigate the evolving legal environment.

Technological Innovations

Blockchain technology, which forms the foundation of cryptocurrencies, is constantly evolving. CryptoweeksBloomberg is at the forefront of reporting on technological innovations in the crypto space, from emerging blockchain projects to breakthroughs in decentralized finance (DeFi) and smart contracts.

Blockchain has vast applications beyond cryptocurrency, with real-world use cases in industries like healthcare, supply chain management, and even voting systems. CryptoweeksBloomberg provides comprehensive coverage on how blockchain innovations are changing these sectors, giving readers a broader understanding of the transformative potential of this technology.

For example, reports on Ethereum’s shift to a proof-of-stake (PoS) consensus mechanism highlight how the platform’s scalability and environmental footprint are improving. Similarly, coverage of DeFi projects delves into how blockchain is disrupting traditional financial services, including lending, borrowing, and decentralized exchanges (DEXs).

Investor Education

Cryptocurrency investment is not without its risks, and CryptoweeksBloomberg is committed to educating investors, both new and experienced, about how to navigate this complicated market. The feature provides valuable advice on making smarter investment choices, such as understanding the risks of investing in highly volatile coins, how to set up a cryptocurrency wallet, and the distinctions between centralized and decentralized exchanges.

In addition to introductory guides for beginners, CryptoweeksBloomberg also offers more advanced analysis for seasoned investors. Topics such as portfolio diversification, trading strategies, and the long-term outlook of the crypto market are explored, helping readers refine their investment approaches and build a solid understanding of market mechanics.

Key Highlights from CryptoweeksBloomberg

Market Trends and Analysis

One of the most valuable aspects of CryptoweeksBloomberg is its ability to break down complex market data into understandable insights. Periodic reports on market performance are a key feature, offering:

- Price movements: Analysis of the rising and falling prices of major cryptocurrencies.

- Market capitalization and trading volumes: A deep dive into how market capitalization and trading volume affect market dynamics.

- Sentiment analysis: Insights from financial experts on how sentiment influences the market.

During market volatility, CryptoweeksBloomberg provides timely advice, helping investors avoid panic selling and spot buying opportunities. Additionally, it offers clarity during bullish trends, pointing out the underlying factors that drive these price rallies.

Regulatory Coverage

Regulation is one of the biggest challenges in the crypto world. CryptoweeksBloomberg does an excellent job of covering the global regulatory landscape, detailing decisions made by the SEC and other regulatory authorities, and assessing how these decisions impact crypto markets. It also highlights notable trends in different regions, such as the embrace of cryptocurrencies by countries like El Salvador and the more restrictive stance in places like China.

Technological Innovations

Blockchain’s potential extends far beyond digital currency. CryptoweeksBloomberg covers a wide array of blockchain innovations, including new smart contract developments and decentralized finance platforms. As blockchain continues to redefine industries, CryptoweeksBloomberg is committed to staying ahead of the curve and exploring new applications of this technology in healthcare, supply chains, and beyond.

Expert Commentary

CryptoweeksBloomberg also features interviews and opinion pieces from leading financial experts, providing readers with insight into the latest trends and predictions for the crypto market. These expert analyses help demystify the complex factors influencing market conditions, such as the impact of macroeconomic trends or geopolitical events on cryptocurrency markets.

The Broader Impact of CryptoweeksBloomberg

Educating Investors

Through tutorials, explainers, and accessible content, CryptoweeksBloomberg is making cryptocurrencies more understandable to the average person. Whether it’s a beginner trying to understand how crypto wallets work or an advanced investor looking for deeper market insights, CryptoweeksBloomberg caters to all levels of knowledge.

Building Trust

With the prevalence of scams and misinformation in the cryptocurrency space, CryptoweeksBloomberg provides a reliable source of truth. Bloomberg’s commitment to fact-checking and delivering accurate data helps foster trust in the information presented. In a market where fraudulent schemes are common, CryptoweeksBloomberg’s ability to offer clarity is invaluable.

Driving Institutional Adoption

One of the most significant ways CryptoweeksBloomberg has impacted the market is by showcasing the increasing interest from institutional investors in digital assets. Coverage of Bitcoin ETFs, the rise of blockchain use by corporations, and the growing participation of hedge funds and venture capital firms underscores how cryptocurrencies are transitioning from a niche market to a mainstream financial asset.

Challenges in Crypto Reporting

While CryptoweeksBloomberg plays a crucial role in the cryptocurrency ecosystem, it also faces significant challenges:

- Volatility: The unpredictable nature of cryptocurrency prices makes it difficult to predict long-term trends.

- Regulatory Uncertainty: With regulations constantly evolving, keeping readers informed on the latest developments is a major task.

- Technical Complexity: Breaking down intricate technical details of blockchain and cryptocurrencies in a way that resonates with both experts and general audiences requires clear communication.

What Lies Ahead for CryptoweeksBloomberg

As cryptocurrencies evolve and new technologies emerge, CryptoweeksBloomberg will continue to provide timely and relevant coverage. Some of the key topics likely to be explored in the future include:

- The integration of artificial intelligence (AI) with blockchain technology.

- Developments in central bank digital currencies (CBDCs).

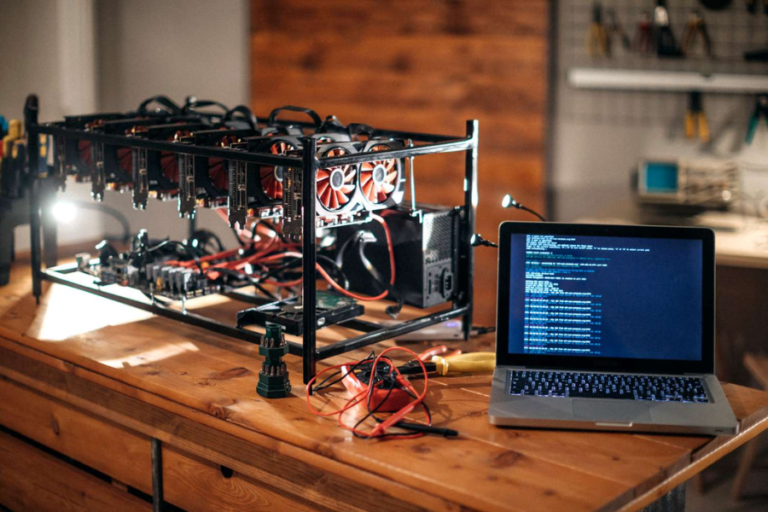

- The environmental impact of crypto mining and potential solutions.

- Innovations in layer-2 scaling solutions for blockchain networks.

By staying ahead of these trends, CryptoweeksBloomberg will remain a valuable resource for anyone interested in the world of cryptocurrencies.

Conclusion

CryptoweeksBloomberg has become an essential resource for cryptocurrency enthusiasts, investors, and anyone interested in the world of digital assets. Through its comprehensive market analysis, educational content, and expert commentary, it has earned its place as a leading source of crypto news. As the cryptocurrency market continues to mature, CryptoweeksBloomberg will undoubtedly play a key role in educating and guiding investors, bridging the gap between technical complexities and mainstream understanding.

Whether you are a seasoned investor or a curious newcomer, CryptoweeksBloomberg provides the tools, insights, and expert guidance needed to navigate the exciting and often volatile world of cryptocurrencies.

FAQs

What is CryptoweeksBloomberg?

CryptoweeksBloomberg is a feature from Bloomberg that provides in-depth analysis, market insights, regulatory updates, and technological innovations related to the world of cryptocurrencies. It offers expert commentary and educational content designed for both seasoned investors and newcomers.

How does CryptoweeksBloomberg help investors?

CryptoweeksBloomberg helps investors by providing valuable market insights, detailed reports on cryptocurrency price movements, trading volumes, and market capitalization. Additionally, it offers expert analysis, sentiment analysis, and strategies to navigate market volatility and make informed investment decisions.

What kind of regulatory updates does CryptoweeksBloomberg cover?

CryptoweeksBloomberg covers key regulatory developments affecting the cryptocurrency market, including decisions from regulatory bodies such as the SEC, tax laws related to crypto transactions, and global regulatory trends. It provides balanced coverage of both favorable regulations and those that could potentially stifle innovation.

Does CryptoweeksBloomberg cover blockchain technology beyond cryptocurrencies?

Yes, CryptoweeksBloomberg frequently covers blockchain innovations beyond digital currencies. This includes advancements in decentralized finance (DeFi), smart contracts, and how blockchain is being applied in sectors like healthcare, supply chain management, and voting systems.

Is CryptoweeksBloomberg suitable for beginners?

Absolutely. CryptoweeksBloomberg provides educational content such as beginner’s guides on topics like setting up a cryptocurrency wallet, understanding the risks of crypto investments, and differentiating between centralized and decentralized exchanges. It also offers more advanced content for experienced investors.

What challenges does CryptoweeksBloomberg face in crypto reporting?

CryptoweeksBloomberg faces several challenges, including the extreme volatility of cryptocurrency prices, regulatory uncertainty, and the technical complexity of blockchain technologies. Despite these challenges, Bloomberg’s team works to deliver clear, accurate, and timely content for its audience.

What can we expect from CryptoweeksBloomberg in the future?

As the cryptocurrency space evolves, CryptoweeksBloomberg is expected to continue exploring emerging topics such as the integration of artificial intelligence with blockchain, developments in central bank digital currencies (CBDCs), the environmental impact of crypto mining, and innovations in scaling blockchain networks.

How does CryptoweeksBloomberg build trust among its readers?

CryptoweeksBloomberg builds trust by providing accurate, fact-checked information and expert insights. With the prevalence of misinformation and scams in the crypto space, Bloomberg’s commitment to delivering reliable and well-researched content helps foster confidence among readers.

What impact has CryptoweeksBloomberg had on institutional adoption of cryptocurrencies?

CryptoweeksBloomberg has played a significant role in highlighting the increasing interest of institutional investors in cryptocurrencies. By covering developments such as Bitcoin ETFs and the rise of blockchain adoption by major corporations, CryptoweeksBloomberg has helped legitimize digital assets in the eyes of mainstream financial institutions.

Is CryptoweeksBloomberg free to access?

While Bloomberg provides free access to some of its articles, access to CryptoweeksBloomberg’s in-depth coverage and premium content may require a Bloomberg subscription.