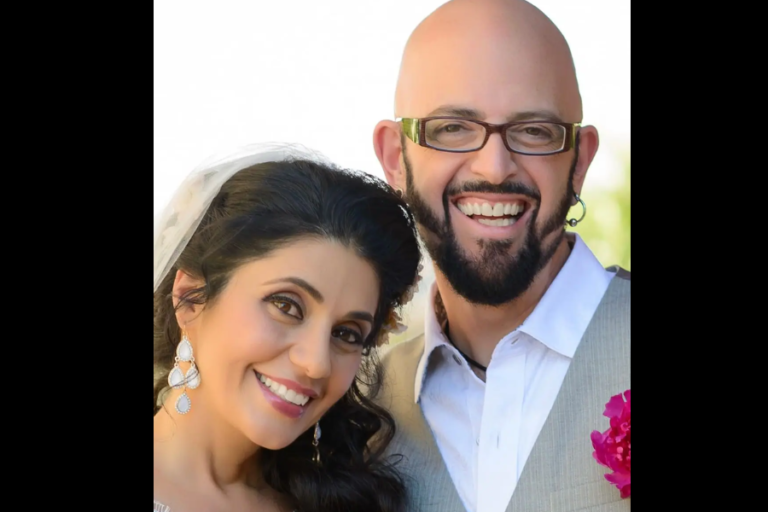

Chris Sacca Net Worth: A Deep Dive into the Billionaire Investor’s Journey

Chris Sacca is a name that resonates deeply in the world of venture capital. Known for his sharp business instincts and visionary investments, Sacca has built an empire, turning early investments into some of the biggest names in the tech industry. As of 2024, Chris Sacca’s estimated net worth is close to $1.3 billion, a remarkable figure that speaks volumes about his foresight and strategic investments. But what’s behind this massive fortune? How did Sacca transition from a young law graduate to one of the most successful investors in Silicon Valley? In this article, we’ll break down his wealth, the companies he’s invested in, his career trajectory, and the key principles that led him to amass such wealth.

Chris Sacca Net Worth in 2024

As of 2024, Chris Sacca net worth is estimated at $1.3 billion. This impressive fortune didn’t come overnight, and it’s a reflection of his incredible success in the venture capital world. The bulk of his wealth comes from early investments in high-growth tech companies that have since transformed into global giants. Companies such as Twitter, Uber, and Instagram, all of which he invested in at their nascent stages, contributed significantly to his current net worth. His venture capital firm, Lowercase Capital, played a crucial role in identifying and nurturing these startups into the powerhouses they are today.

What sets Sacca apart is not just his ability to predict the next big tech breakthrough, but his long-term approach to building relationships with entrepreneurs. Over the years, his keen eye for spotting potential and his unshakeable confidence in the entrepreneurs he backs have propelled him to a place of prominence in the venture capital world.

How Did Chris Sacca Make His Money?

Chris Sacca’s wealth didn’t stem from one lucky break but from a series of strategic investments. His entrepreneurial journey began with a strong foundation in law. After studying law at the University of Michigan, Sacca began his career as an attorney at Fenwick & West, a law firm known for its expertise in venture capital and technology. At Fenwick & West, Sacca gained invaluable insights into how startups are structured, how venture capital deals work, and what legal hurdles entrepreneurs face. This experience would become essential later when he transitioned to investing.

After leaving Fenwick & West, Sacca made the bold decision to dive into the tech world. He joined Google as the Head of Special Initiatives. It was here that Sacca honed his skills in recognizing the potential of tech innovations and understanding how the internet could change the world. However, his real breakthrough came when he decided to venture out on his own and start Lowercase Capital.

Lowercase Capital allowed Sacca to follow his passion for finding startups that were not just profitable but were poised to change the world. By getting in early, Sacca was able to make investments that would yield incredible returns. One of his most famous early investments was in Twitter. In the early days, Twitter was a fledgling company with a unique idea—short messages that could spread across the internet. Sacca saw the potential for the platform to change the way people communicate and invested early, reaping the rewards as Twitter grew into a multi-billion-dollar company.

Uber, another company that became a key part of his portfolio, was equally transformative. At the time of Sacca’s investment, Uber was a small startup, and its business model was unproven. However, Sacca believed in the company’s potential to disrupt the transportation industry, and his investment paid off handsomely as Uber rapidly expanded across the globe.

Chris Sacca’s investment philosophy focuses on finding disruptive, innovative ideas and supporting them with both financial backing and mentorship. His ability to identify trends and technologies before they become mainstream has allowed him to build a diverse and lucrative portfolio.

Key Investments in Chris Sacca’s Portfolio

Chris Sacca’s portfolio is a who’s who of the most influential tech companies in the world. Over the years, Lowercase Capital has invested in more than 40 startups, ranging from social media platforms to transportation, financial services, and even coffee. Some of his most notable investments include:

- Twitter – Arguably his most famous investment, Sacca got involved with Twitter early on and helped the company grow into one of the most important social media platforms in the world.

- Uber – Sacca was an early investor in Uber, the ride-sharing giant that revolutionized the transportation industry. Uber has since become one of the most valuable private companies in the world.

- Instagram – Sacca was also an early investor in Instagram, the photo-sharing app that was eventually acquired by Facebook for $1 billion. Instagram’s growth has been explosive, and it remains one of the most popular social media platforms today.

- Twilio – Twilio, a cloud communications company, was another success story from Sacca’s portfolio. It has become a leader in cloud-based communication infrastructure, powering a range of services for companies around the world.

- Stripe – Stripe, a company that enables online payment processing, was another of Sacca’s successful investments. Stripe has grown rapidly, attracting attention from major investors and companies alike.

- Blue Bottle Coffee – Sacca didn’t limit his investments to tech companies. He also saw the potential in Blue Bottle Coffee, a high-end coffee brand that has since expanded across the U.S. and internationally.

- Docker – Docker, a company focused on software containerization, was another of Sacca’s successful investments. Docker has become an essential tool for developers in the tech industry.

- Kickstarter – Sacca also saw the potential of Kickstarter, a crowdfunding platform that allows creators to fund their projects. Kickstarter has helped launch countless innovative ideas and products.

This is just a small sampling of the companies Sacca has invested in over the years. The breadth of his investments showcases his ability to spot opportunity across a variety of industries, not just tech.

Chris Sacca’s Investment Philosophy

Chris Sacca’s success as an investor is driven by a unique approach to venture capital. His investment philosophy can be boiled down to a few key principles:

- Focus on the Long-Term: Sacca doesn’t look for quick wins. He prefers to invest in companies with long-term potential and is willing to give startups time to grow and mature before expecting returns.

- Invest in Disruptive Technologies: Sacca’s approach centers around finding companies that are disrupting traditional industries. Whether it’s social media, transportation, or communications, Sacca looks for startups that have the potential to change the way people live and work.

- Support Entrepreneurs: Sacca doesn’t just invest money; he actively supports the entrepreneurs behind the companies he invests in. His role as a mentor and advisor has been crucial to the success of many of the startups in his portfolio.

- Take Calculated Risks: Sacca isn’t afraid to take risks, but they’re always calculated. He believes that in order to succeed in venture capital, you need to be willing to take chances on unconventional ideas and untested business models.

- Leverage Social Media and Networks: Sacca has been vocal about how social media played a role in his success. He’s used platforms like Twitter and blogs to connect with entrepreneurs, share his ideas, and spot emerging trends.

Overcoming Early Challenges

Chris Sacca’s path to success wasn’t always smooth sailing. In fact, he faced significant financial struggles early on in his career. After law school, Sacca found himself in substantial debt. However, rather than giving up, he leveraged his skills in finance and made some smart moves in the stock market that helped him recover from this setback. This experience served as a pivotal turning point in his life and career. It taught him the importance of resilience and thinking strategically during difficult times, lessons that would prove invaluable as he later transitioned into venture capital.

Chris Sacca’s Other Ventures and Interests

Beyond his work in venture capital, Chris Sacca has a wide range of interests and ventures. He has been involved in several philanthropic endeavors, particularly in areas related to education and technology. Sacca has also invested in real estate, cryptocurrencies, and art, further diversifying his portfolio.

His passion for innovative technologies and entrepreneurship extends into his personal life as well. Sacca has been known to mentor and advise young entrepreneurs, sharing his knowledge and helping them navigate the complex world of startups and venture capital.

Conclusion

Chris Sacca’s journey from a law firm attorney to a billionaire venture capitalist is an inspiring story of hard work, resilience, and visionary thinking. With a portfolio that includes some of the world’s most successful companies, his net worth is a reflection of his unparalleled ability to spot trends, invest wisely, and support entrepreneurs. His story serves as a blueprint for aspiring investors and entrepreneurs alike, showing that with the right mindset and a willingness to take calculated risks, it’s possible to turn big ideas into even bigger successes.

As of 2024, Chris Sacca net worth is just the latest chapter in his ongoing journey in the world of venture capital. His future in tech and investing remains bright, and his legacy as one of the most successful venture capitalists of his generation is secure.

FAQs

What is Chris Sacca net worth in 2024?

As of 2024, Chris Sacca net worth is estimated at $1.3 billion. This wealth is primarily attributed to his early investments in successful companies like Twitter, Uber, Instagram, and several other tech startups through his venture capital firm, Lowercase Capital.

How did Chris Sacca become so successful?

Chris Sacca’s success stems from his keen ability to identify promising startups early in their development. By investing in disruptive companies like Twitter, Uber, and Instagram, he was able to benefit from the massive growth of these tech giants. Additionally, his approach to venture capital—focusing on long-term potential, calculated risks, and supporting entrepreneurs—has played a critical role in his success.

What companies has Chris Sacca invested in?

Some of the most notable companies in Chris Sacca’s investment portfolio include Twitter, Uber, Instagram, Twilio, Stripe, Kickstarter, Docker, and Blue Bottle Coffee. These companies span various industries such as tech, transportation, coffee, and crowdfunding, demonstrating Sacca’s diverse investment strategy.

What is Lowercase Capital?

Lowercase Capital is Chris Sacca’s venture capital firm, known for its successful investments in early-stage startups. The firm has been behind several high-profile investments, including Twitter, Uber, and Instagram, and is recognized for its strategic approach to supporting innovative companies with high growth potential.

How did Chris Sacca get his start in the venture capital world?

Sacca started his career as an attorney at Fenwick & West, where he gained valuable experience in corporate law and venture capital. After leaving the firm, he joined Google in a strategic role, further enhancing his knowledge of the tech industry. He later founded Lowercase Capital, where he began making his well-known early-stage investments in tech startups.

What is Chris Sacca’s investment philosophy?

Chris Sacca’s investment philosophy focuses on identifying and supporting companies that are disrupting industries or creating new markets. He is known for his long-term vision, willingness to take calculated risks, and hands-on approach in mentoring entrepreneurs. Sacca also values social media and networking as tools to stay ahead of trends and discover emerging opportunities.

Has Chris Sacca been involved in any other ventures outside of venture capital?

Yes, in addition to his work with Lowercase Capital, Sacca has invested in areas such as real estate, cryptocurrencies, and art. He has also been involved in various philanthropic efforts, particularly in education and technology, and is known for mentoring and advising young entrepreneurs.

What are some key lessons from Chris Sacca’s career?

Some key lessons from Sacca’s career include the importance of resilience, the ability to spot disruptive trends early, the value of building strong relationships with entrepreneurs, and the willingness to take calculated risks. His career underscores the significance of a long-term investment mindset and staying adaptable in a constantly changing business landscape.