Understanding Crypto Currencies: A Comprehensive Guide & More Explore

Cryptocurrency has become a prominent topic in the world of finance and technology, evolving into a multi-billion dollar market in just over a decade. While it holds significant promise for revolutionizing financial transactions, its complexities, risks, and opportunities can make it challenging to understand. In this guide, we will break down what cryptocurrency is, how it works, how to buy and store it, and explore the benefits and risks involved.

What are Crypto Currencies?

Crypto Currencies is a type of digital or virtual currency that uses cryptography to secure transactions and control the creation of new units. Unlike traditional currencies, cryptocurrencies operate without a central authority, such as a government or bank, to regulate them. Instead, they rely on decentralized systems that enable peer-to-peer transactions.

Crypto Currencies exist purely in digital form and are stored in digital wallets. They are typically used for online transactions, where traditional payment methods, like credit cards or bank transfers, might not be ideal. The key feature of cryptocurrencies is their underlying technology, known as blockchain, which provides transparency, security, and traceability for every transaction.

The first cryptocurrency, Bitcoin, was introduced in 2009 by an anonymous individual or group of individuals under the pseudonym Satoshi Nakamoto. Since then, many other cryptocurrencies have emerged, each offering various features and applications. Today, Bitcoin remains the most well-known cryptocurrency, though others, like Ethereum, Litecoin, and Ripple, have also gained widespread attention.

How Does Cryptocurrency Work?

Crypto Currencies operate on a decentralized ledger called blockchain. A blockchain is essentially a public record of all transactions made using a particular cryptocurrency. The data is stored in “blocks,” and each time a new transaction occurs, a new block is added to the chain. This creates a secure and tamper-proof record of transactions that anyone can verify.

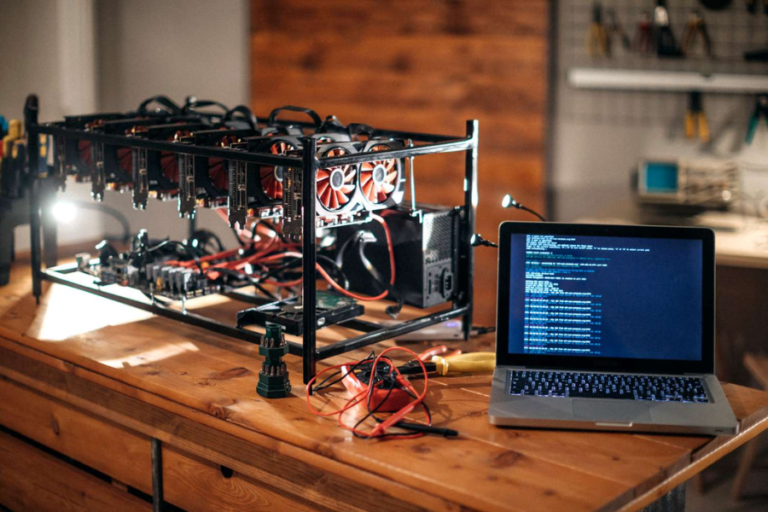

The process of creating new cryptocurrency units is called mining. Mining involves using powerful computers to solve complex mathematical problems, and the first miner to solve the problem gets rewarded with new units of the cryptocurrency. While this process can be resource-intensive, it is essential to maintaining the integrity and security of the cryptocurrency network.

Crypto Currencies When you own cryptocurrency, you’re not actually holding physical coins or bills. What you own is a unique private key that allows you to move a specific amount of cryptocurrency from one address to another. This private key is what grants you access to your funds and is crucial for making secure transactions.

Cryptocurrency Examples

There are thousands of cryptocurrencies in existence, but here are some of the most notable ones:

Bitcoin (BTC)

Launched in 2009 by Satoshi Nakamoto, Bitcoin was the first-ever cryptocurrency. It remains the most widely used and recognized digital currency. Bitcoin has experienced significant price volatility, but its overall value has risen dramatically since its inception.

Ethereum (ETH)

Launched in 2015 by Vitalik Buterin, Ethereum is both a cryptocurrency and a decentralized blockchain platform. The cryptocurrency associated with Ethereum is called Ether (ETH). Ethereum introduced smart contracts, which are self-executing contracts with the terms directly written into code. Ethereum is the second most popular cryptocurrency after Bitcoin.

Litecoin (LTC)

Launched in 2011 by Charlie Lee, Litecoin is based on the Bitcoin model but with some key differences. Litecoin transactions are faster and have lower fees compared to Bitcoin. It has often been referred to as the “silver” to Bitcoin’s “gold.”

Ripple (XRP)

Ripple is both a cryptocurrency and a payment network. Unlike many other cryptocurrencies, Ripple’s XRP token isn’t mined. Instead, all XRP tokens were pre-mined when the network was launched in 2012. Ripple is known for its focus on facilitating fast, low-cost international transactions and has formed partnerships with several financial institutions.

How to Buy Crypto Currencies

Purchasing cryptocurrency might seem complicated, but it’s relatively straightforward once you Crypto Currencies understand the process. Here are the three main steps involved in buying cryptocurrency:

Step 1: Choosing a Platform

The first step is choosing where to buy your cryptocurrency. There are two main types of platforms available for buying and trading digital currencies:

- Traditional Brokers: These are platforms like Robinhood or eToro, where you can buy and sell cryptocurrencies, as well as other assets like stocks and bonds. They typically charge lower fees but may have fewer cryptocurrency-specific features.

- Cryptocurrency Exchanges: These platforms specialize in digital currencies, offering a wide range of options for buying, selling, and trading. Some popular cryptocurrency exchanges include Coinbase, Binance, and Kraken. While they tend to charge higher fees, they provide a more extensive range of cryptocurrencies and additional features like wallet storage and advanced trading options.

When choosing a platform, consider the types of cryptocurrencies they support, the fees they Crypto Currencies charge, their security measures, and any additional features such as interest-bearing accounts or educational resources.

Step 2: Funding Your Account

Once you’ve chosen your platform, the next step is funding your account. Most exchanges accept fiat currencies like the US Dollar, Euro, or British Pound. You can fund your account using methods like:

- Bank Transfer: ACH or wire transfers are common methods for depositing funds into your account.

- Debit/Credit Cards: Many platforms allow you to purchase cryptocurrencies using credit or debit cards, though this method may incur higher fees.

- Other Payment Methods: Some platforms also accept alternative payment methods like PayPal, Cash App, or even direct cryptocurrency transfers.

Remember that some payment methods, like credit cards, can be risky due to the volatile nature of cryptocurrencies, so it’s best to use caution when purchasing with borrowed funds.

Step 3: Placing an Order

After funding your account, you can place an order to buy cryptocurrency. You can choose from various order types, Crypto Currencies including market orders (where you buy at the current market price) and limit orders (where you specify a price at which you’re willing to buy). Once your order is confirmed, your cryptocurrency will be credited to your account.

How to Store Cryptocurrency

Once you’ve bought cryptocurrency, it’s important to store it securely. Digital currencies are stored in crypto wallets, which are tools that allow you to manage your private keys and conduct transactions.

There are two main types of wallets:

Hot Wallets

Hot wallets are online wallets that store your private keys on internet-connected devices like computers or smartphones. These wallets are convenient because you can access them from anywhere, but they are more vulnerable to hacks. Examples of hot wallets include Coinbase Wallet and Metamask.

Cold Wallets

Cold wallets are offline storage options that keep your private keys in physical devices or paper form. Cold wallets are generally more secure since they are not connected to the internet, making them less susceptible to hacking. Examples of cold wallets include Ledger and Trezor hardware wallets.

While cold wallets tend to come with additional costs, they are the safer option for long-term storage of your cryptocurrency.

What Can You Buy with Cryptocurrency?

While cryptocurrencies were initially designed for use as a digital payment method, their adoption for everyday purchases is still limited. However, a growing number of businesses accept cryptocurrencies as payment for goods and services. Some examples include:

Technology and E-Commerce Sites

Several major tech companies accept cryptocurrency payments, including Newegg, AT&T, Microsoft, and Overstock. Platforms like Shopify and Rakuten also support cryptocurrency payments.

Luxury Goods

Some luxury retailers accept cryptocurrencies in exchange for high-end items like watches, jewelry, and even cars. For example, Bitdials offers luxury watches from brands like Rolex and Patek Philippe in return for Bitcoin.

Cars and Real Estate

Certain car dealerships and even real estate companies are beginning to accept cryptocurrency as payment for vehicles and properties.

If a retailer doesn’t accept crypto directly, you can use services like BitPay to convert your cryptocurrency into fiat currency for use at places that don’t accept digital currencies.

Cryptocurrency Fraud and Scams

Despite the security features of cryptocurrencies, the rise of digital currencies has unfortunately attracted a surge in fraud and scams. Common scams include:

- Fake Websites: Fraudulent websites promise huge returns on investments but are designed to steal your money.

- Ponzi Schemes: Some scammers run Ponzi schemes, attracting new investors with promises of high returns and using their money to pay earlier investors.

- Celebrity Endorsement Scams: Scammers impersonate famous individuals to promote fraudulent crypto investments.

- Romance Scams: Scammers target people through dating apps, convincing them to invest in cryptocurrencies.

- Hacking: Cryptocurrency exchanges and wallets are frequent targets for hackers.

To stay safe, always use reputable platforms, research thoroughly, and beware of unsolicited offers.

Is Cryptocurrency Safe?

Cryptocurrencies are generally considered safe due to the use of blockchain technology, which records transactions in a secure, tamper-resistant manner. Additionally, two-factor authentication adds another layer of security. However, they are not immune to risks. Hacks, fraud, and price volatility are all significant concerns.

In addition, unlike traditional investments, cryptocurrencies are largely unregulated, meaning investors have less protection if something goes wrong.

Four Tips for Investing in Cryptocurrency Safely

If you’re considering investing in cryptocurrency, here are some tips to help you navigate the market:

- Research Exchanges: Learn about the different exchanges and their security measures before you invest.

- Know How to Store Your Digital Currency: Understand the different types of wallets and choose one that suits your needs.

- Diversify Your Investments: Don’t invest all your funds in a single cryptocurrency; diversify to reduce risk.

- Prepare for Volatility: Cryptocurrency markets are highly volatile. Be prepared for significant price fluctuations and only invest what you can afford to lose.

Facts

- Digital and Decentralized: Cryptocurrencies are digital currencies that operate without a central authority like a bank or government, relying on blockchain technology for transaction transparency and security.

- Blockchain Technology: All cryptocurrency transactions are recorded on a blockchain, which is a decentralized, tamper-proof ledger.

- Bitcoin Pioneered Cryptocurrencies: Bitcoin, introduced in 2009 by the pseudonymous Satoshi Nakamoto, was the first cryptocurrency, laying the foundation for others to follow.

- Mining: The process of creating new units of cryptocurrency, known as mining, involves solving complex mathematical problems. Miners are rewarded with new coins or tokens for securing the network.

- Thousands of Cryptocurrencies: While Bitcoin is the most famous, there are thousands of other cryptocurrencies, including Ethereum, Litecoin, and Ripple, each offering unique features or use cases.

- Wallets for Storage: Cryptocurrencies are stored in digital wallets, which can be either “hot wallets” (connected to the internet) or “cold wallets” (offline storage devices), with cold wallets being more secure.

- Risks Involved: Despite their security features, cryptocurrencies come with risks such as hacking, fraud, and price volatility. They are also largely unregulated.

- Increasing Acceptance: More businesses are accepting cryptocurrencies as payment, including major tech companies, luxury retailers, and even real estate firms.

Summary

Cryptocurrency is a digital currency secured by cryptography and operates on decentralized networks using blockchain technology. The first and most famous cryptocurrency, Bitcoin, was introduced in 2009, and since then, thousands of other digital currencies, like Ethereum and Litecoin, have emerged. These currencies are stored in digital wallets, which can be online (hot wallets) or offline (cold wallets).

To buy cryptocurrency, users typically choose between traditional brokers or cryptocurrency exchanges, fund their accounts, and then place orders for their desired coins. Cryptocurrency offers several benefits, such as security, fast transactions, and lower fees in some cases, but it is also associated with high volatility, fraud risks, and a lack of regulation.

Despite these risks, cryptocurrency is gaining wider acceptance, with more businesses starting Crypto Currencies to accept it for payment. However, it remains essential for users to stay informed and use reputable platforms to ensure safe transactions and investments.

FAQs

What is cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography to secure transactions and operates on decentralized networks. It is not regulated by any central authority like a government or bank.

How do cryptocurrencies work?

Cryptocurrencies work on a blockchain, a decentralized ledger that records transactions. These transactions are validated through mining, where miners solve complex problems to add new blocks to the chain.

What is Bitcoin?

Bitcoin is the first cryptocurrency, introduced in 2009 by an anonymous figure known as Satoshi Nakamoto. It remains the most well-known and widely used cryptocurrency.

How can I buy cryptocurrency?

You can buy cryptocurrency through platforms like cryptocurrency exchanges (e.g., Coinbase, Binance) or traditional brokers (e.g., Robinhood). You’ll need to fund your account and place an order to buy the digital coins.

What are hot and cold wallets?

Hot wallets are online wallets connected to the internet, making them more convenient but less secure. Cold wallets, like hardware wallets, store your cryptocurrency offline and are generally considered safer.

Can I use cryptocurrency to buy things?

Yes, some businesses accept cryptocurrencies like Bitcoin or Ethereum for payment, including tech companies, luxury goods retailers, and even real estate agencies.

Is cryptocurrency safe to invest in?

Cryptocurrencies are generally secure, but there are risks involved, including price volatility, hacking, fraud, and lack of regulation. It’s important to use reputable platforms and diversify investments.

What are the risks of investing in cryptocurrency?

Some of the risks include high volatility, fraud and scams, security breaches, and regulatory uncertainty. Always research thoroughly before investing and only invest what you can afford to lose.

How do I store my cryptocurrency securely?

Cryptocurrencies should be stored in wallets. For better security, use cold wallets (offline storage) instead of hot wallets (online storage). Ensure that you backup your private keys to prevent loss.

How can I protect myself from cryptocurrency scams?

Always use reputable platforms, be cautious of unsolicited offers, and never share your private keys or personal information with untrusted sources. Avoid making impulsive investments based on celebrity endorsements or unrealistic promises.

Discover the latest crypto trends and expert insights at Crypto30x.com.co.